Financial IT encompasses the infrastructures, systems, processes, and applications required by financial services institutions. The past few decades have brought on massive changes for the financial services sector and its IT systems. These changes make it crucial to always keep an eye on financial services IT.

E-finance has brought about increased convenience, accessibility, and efficiency in financial services. This makes it easier for individuals and businesses to manage their money and access a wide range of financial products and services. However, it also comes with its own set of challenges.

The digitalization of financial services and systems has brought on massive changes in the financial industry as Fintech is on the rise:

This change has also brought a lot of challenges in terms of how to manage these heterogeneous infrastructures and make them more secure at the same time.

For FSI businesses, security remains the top priority and the top challenge. With the move online, there are now more ways for systems to be compromised:

IT professionals in these environments need to ensure that all internal as well as external-facing networks utilize the latest in security technology. And of course, physical security is still important and includes aspects such as facility access control and CCTV cameras.

For a bank, stock trader, or insurance company to get a meaningful overview of their financial IT system can be challenging as well:

As financial IT infrastructures are becoming more complex, IT professionals need to find a tool that brings the various systems, devices, technologies, and locations together in a unified overview.

Diagnose issues with your e-finance infrastructure by continuously monitoring your hardware, applications, bandwidth, availability, and more. Show monitoring data in real time and visualize it in graphic maps & dashboards to identify problems more easily. Gain the visibility you need to troubleshoot issues before they become critical.

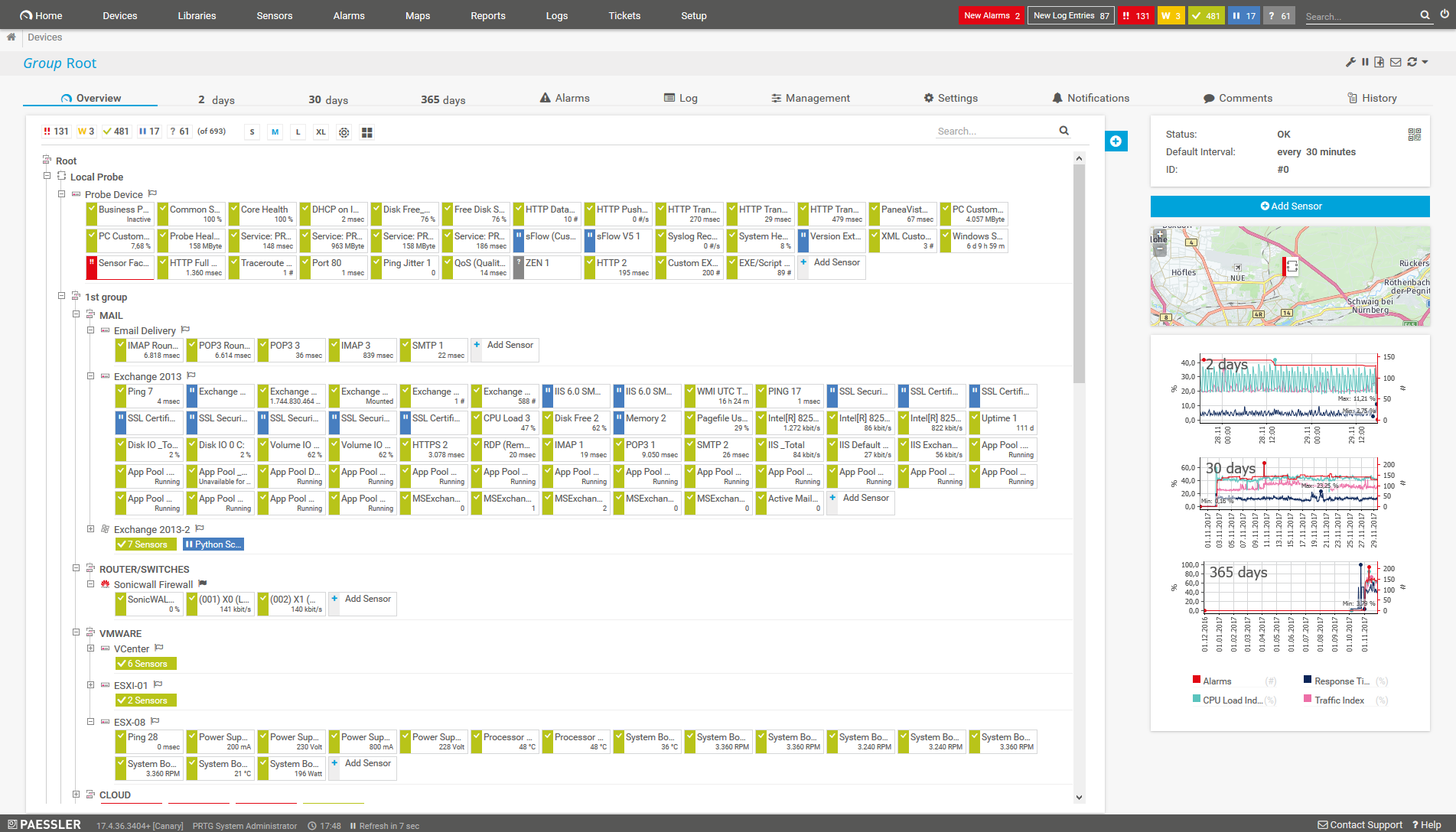

Device tree view in PRTG with hierarchical structure

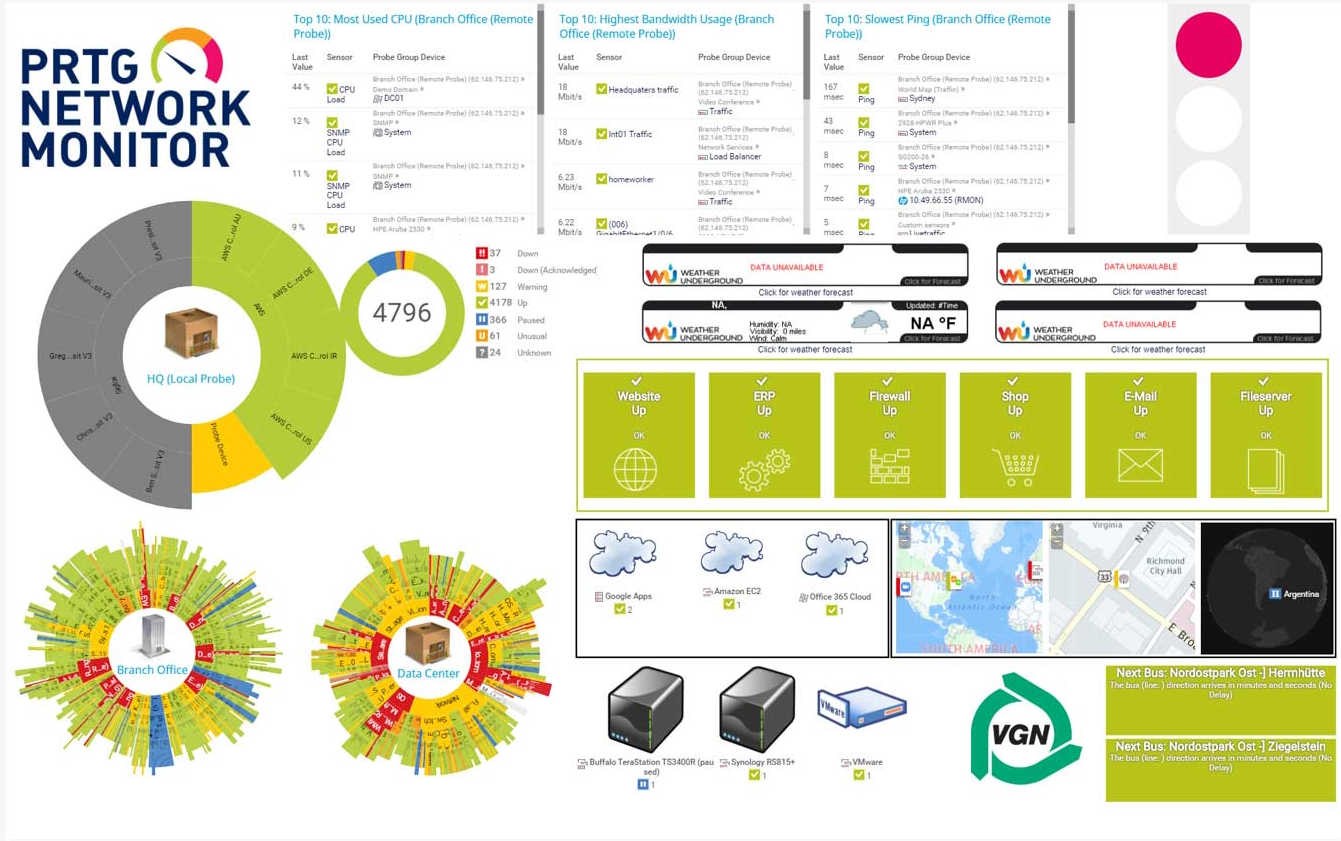

Custom PRTG dashboard for visualizing IT infrastructure monitoring

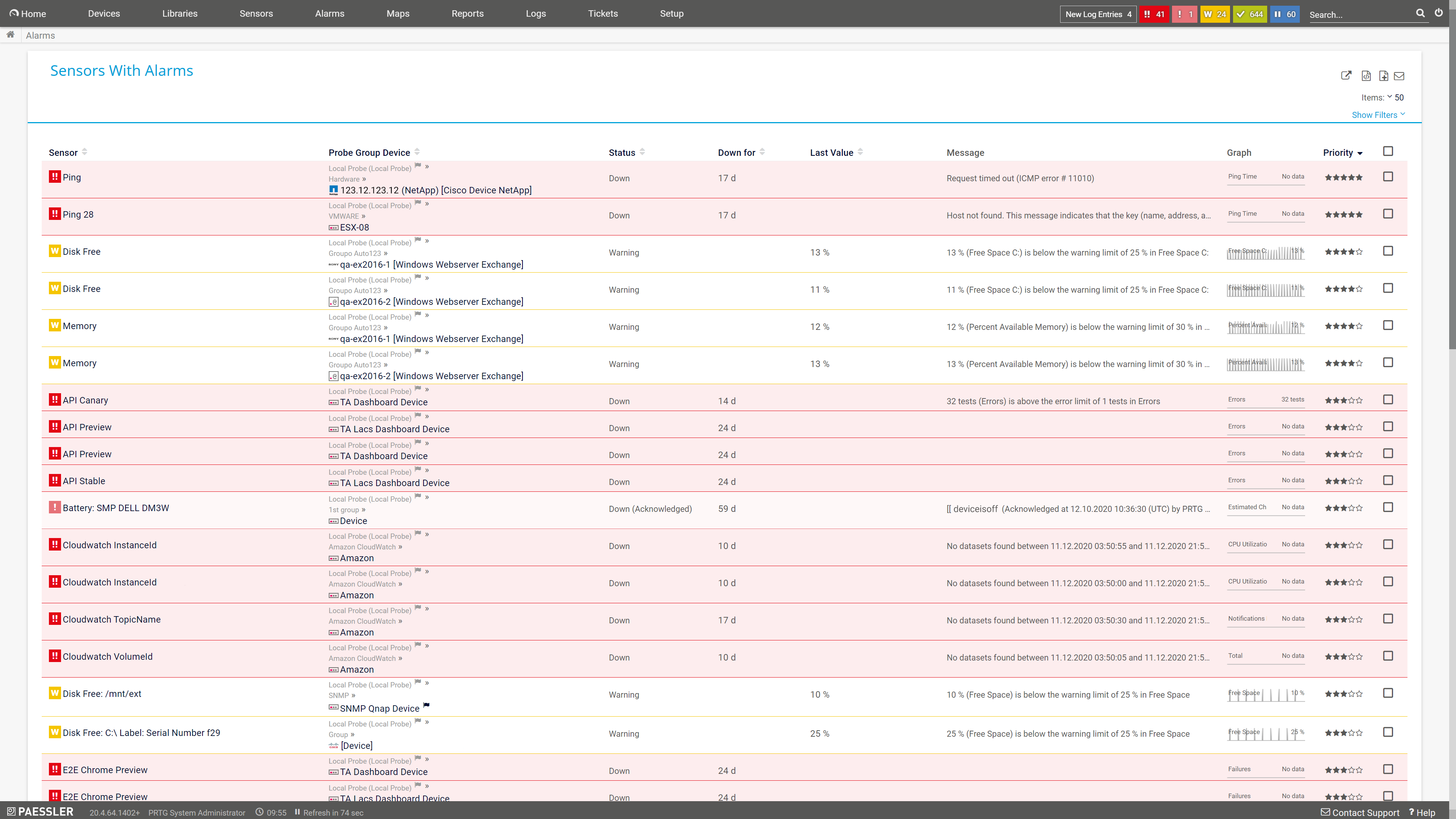

Overview of all warning and error alerts detected by PRTG sensors

“Excellent tool for detailed monitoring. Alarms and notifications work greatly. Equipment addition is straight forward and server initial setup is very easy. ...feel safe to purchase it if you intend to monitor a large networking landscape.”

Partnering with innovative IT vendors, Paessler unleashes synergies to create

new and additional benefits for joined customers.

Combining PRTG’s broad monitoring feature set with IP Fabric’s automated network assurance creates a new level of network visibility and reliability.

Asset visibility is a big problem for many IT teams. Not having an accurate inventory of tech assets is inefficient, costly and a potential security risk.

Osirium’s experienced management team has an outstanding track record in cybersecurity and automation, establishing its headquarters near Reading, UK.

Companies around the world trust PRTG Network Monitor when it comes to ensuring that their IT systems run smoothly.

Hume Bank is a financial institution offering north-eastern Victoria and southern New South Wales a local banking alternative that isn’t owned by profit driven shareholders. With PRTG, Hume Bank gains greater insight into the organization's IT networks to help maintain a highly available platform for the business and its customers, crucial for a financial organization built on trust.

At Rüsselsheimer Volksbank eG, 158 employees manage investments and develop financial & retirements plans for their customers. Without a reliable IT infrastructure, the bank cannot provide these services. PRTG helps prevent failures in the IT infrastructure and also automates many of the bank’s troubleshooting tasks, such as the rebooting of important services.

Active in the market since 1995, Banca Profilo is an institution that specializes in private and investment banking as well as asset management. Banca Profilo manages its IT infrastructure primarily in-house and uses PRTG to monitor its on-premises data center as well as six branches and an extranet network with site-to-site connections to outsourcers of several critical services.

E-finance, short for electronic finance, refers to the use of electronic technology and digital platforms to conduct various financial transactions and manage financial activities. It encompasses a wide range of financial services and activities that are carried out electronically, often over the internet.

E-finance has become increasingly important in modern finance due to advancements in technology and the growing digitalization of the financial industry.

Financial services IT monitoring refers to the process of closely observing and managing the IT infrastructure and systems within the financial services industry. This monitoring is essential to ensure the reliability, security, and performance of IT systems that are critical to financial institutions' daily operations.

Financial services IT monitoring involves the use of specialized tools, techniques, and practices to keep IT systems running smoothly and securely.

In PRTG, “sensors” are the basic monitoring elements. One sensor usually monitors one measured value in your network, for example the traffic of a switch port, the CPU load of a server, or the free space on a disk drive. On average, you need about 5-10 sensors per device or one sensor per switch port.